Global Contract Research Organizations Market(世界CRO市场概况)

Declining R&D productivity and increasing costs of new product development has lead to an increase in the outsourcing of research processes by pharmaceutical and biotechnology companies. Contract Research Organizations (CROs) offer a wide portfolio of services that include drug discovery, pre- and post-clinical trial, and post-market surveillance services.

The global CRO market was valued at an estimated USD 25 billion in 2015. The market has witnessed a strong, double-digit growth rate over the past decade. It is expected to grow at an annual rate of between 7% to 11% till 2020.

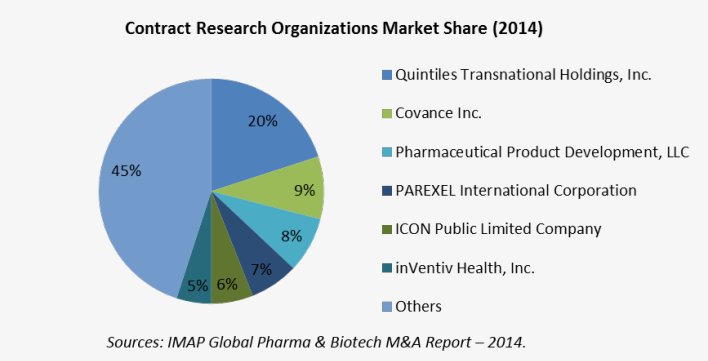

The CRO market is highly consolidated. According IMAP’s Global Pharma & Biotech M&A Report – 2014, the combined market share of the top-10 companies in this market was estimated to be over 75% in 2011. The highly regulated nature of the market and the requirements of high capital investment are important entry barriers for new entrants. They also act as important operational challenges for mid- and small-sized CROs. Between 2007 and 2012, close to 45% of small- and mid-sized CROs were acquired by larger market players or had suspended operations.

CRO公司市场占有率

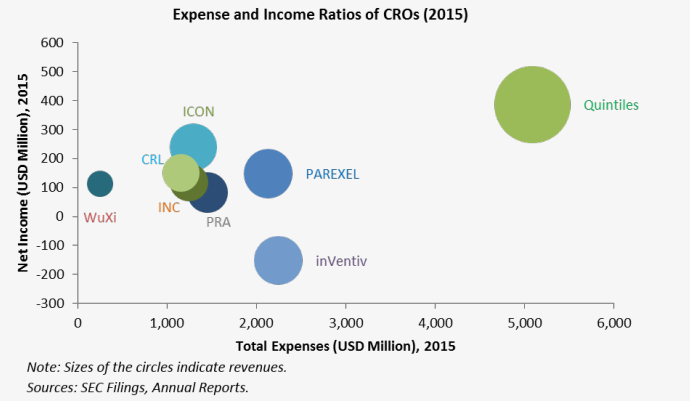

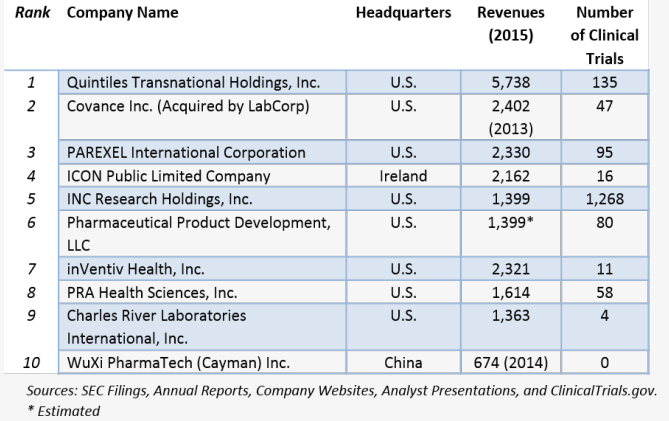

Financial Data for Top-10 CROs

TOP-10CRO公司财务情况

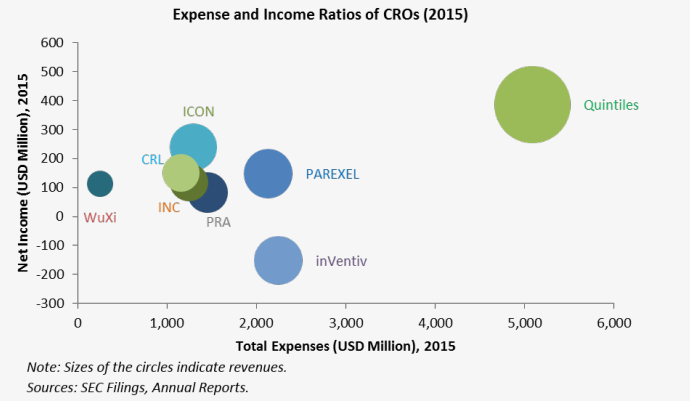

2015CRO公司收支情况

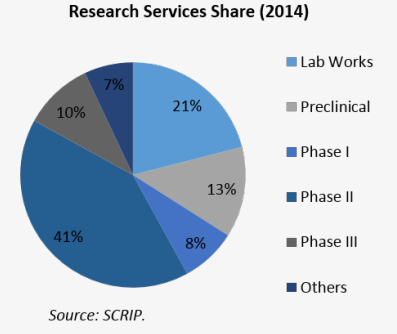

CRO Service Portfolio

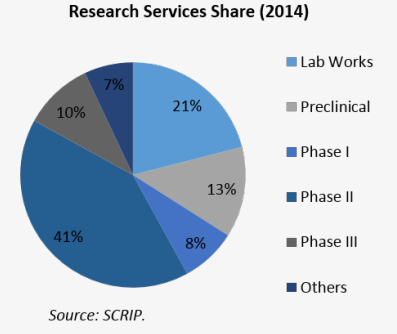

The leaders in this market include a mix of public-listed and privately held organizations from U.S., Europe, and Asia. These organizations offer services across the entire pharmaceutical research spectrum. However, clinical research services had the largest share of the revenues of CRO market in 2014. The revenues for contract services related to phases I, II, and III had a share of close to 60% of the market in 2014.

2014年CRO研究服务类型

Clinical Research Service Portfolio for Top-10 CROs(TOP10 CRO公司临床研究项目)

Partnership Models

Strategic partnerships between pharmaceutical companies and CROs are an important emerging trend in the market. More than half of all biopharmaceutical companies have reported to have entered into strategic partnerships with a small number of preferred service providers – between 1 to 5 CROs. This trend is expected to drive the merger and acquisition activity in this market, increase market consolidation, and strengthen the positions and competitive advantages of market leaders.

Ranking

A ranking system was developed for the top-10 global clinical research organizations. A score statistic was developed to determine the rank of each organization. Revenues and clinical research services portfolios were the most important input criteria for the score statistic of each organization. Total expenses and net incomes were used to refine the statistic. Of the top-10 players in this market, 9 were public organizations that reported their revenues in the public domain. Except for WuXi PharmaTech (Cayman) Inc. and Covance, Inc., financial data for all other organizations was determined for the year 2015. Financial data for the year 2014 was used as a proxy for WuXi PharmaTech, while that for the year 2013 was used as a proxy for Covance.

Ranking of Global CROs(世界CRO公司排名)

Revenues, number of clinical trials, range and scope of service portfolio, net income, and total expenses were the five key input criteria were used to calculate the score statistic for each organization. Every organization was assigned a score for each of these key input criteria. Different weights were assigned to each rank. A weighted sum of the five scores was used to arrive at the final score statistic for each organization. The final score statistic represents the financial health, competitive advantage, and activity status of each organization in the clinical trials domain.

部分CRO公司简介

Quintiles Transnational Holdings, Inc.

Quintiles is the largest player in this market. It had revenues of USD 5,738 million in 2015. The company is headquartered in Durham, North Carolina and is listed on the New York Stock Exchange (NYSE). The company’s net income stood at USD 387 million while its total expenses stood at USD 5,091 million in 2015. The company operates in all domains of clinical research and post-clinical research. However, its portfolio pre-clinical research and drug discovery services in limited.

Covance Inc.

Covance Inc. was acquired by Laboratory Corporation of America Holdings in February 2015. It is headquartered at Princeton, New Jersey. This company has a strong portfolio of clinical and post-clinical services. It also offers a strong suite of pre-clinical services including research models, drug discovery, bioanalysis, and toxicology services.

PAREXEL International Corporation

PAREXEL is headquartered at Waltham, Massachusetts and is listed on the NASDAQ. It had revenues of USD 2,330 million in 2015 and total expenses and net income of USD 2,130 million and USD 148 million respectively. This company too has a strong focus on clinical, post-clinical, and consulting services. However, it does not have a strong presence in pre-clinical services domain.

ICON Public Limited Company

ICON is headquartered at Dublin, Ireland. It is listed on the NASDAQ in the U.S. It had revenues of USD 2,162 million in 2015 and total expenses of USD 1,293 million. This company has a strong portfolio of post-clinical services. It also offers bioanalysis, consulting, and commercialization services.

Pharmaceutical Product Development, LLC

PPD is a privately held organization that is headquartered at Wilmington, North Carolina. This company has a strong portfolio of clinical, pre-clinical, post-clinical, and commercialisation services. It’s portfolio of pre-clinical services includes drug discovery, bioanalysis, and toxicology services.

内容来源于:https://igeahub.com/2016/04/14/top-10-global-cros-in-2016/

相关新闻

相关新闻